STATE EXCISE TAXES ON E.N.D.S. PRODUCTS

With the many changes included in the PACT Act, the term “Excise Taxes” is often mentioned. What exactly are “Excise Taxes” though? We have compiled need-to-know information in regards to these taxes and insights into how they vary from state to state.

WHAT ARE EXCISE TAXES?

“Excise taxes are taxes that are imposed on various goods, services and activities. Such taxes may be imposed on the manufacturer, retailer or consumer, depending on the specific tax.” – IRS.gov

TERMINOLOGY

Many states have different excise taxes based on the style of vaping device being sold. “Open System” and “Closed System” are the terms used to describe the two main types of vaping devices:

Open Systems refer to vape devices that are refillable along with their components. This includes the devices themselves, tanks, cartridges, and e-liquid bottles.

Closed Systems refer to systems and devices that come pre-filled with e-liquid and are not refillable. These include single-use disposable devices, cartridges and pods.

TAXES BY STATE

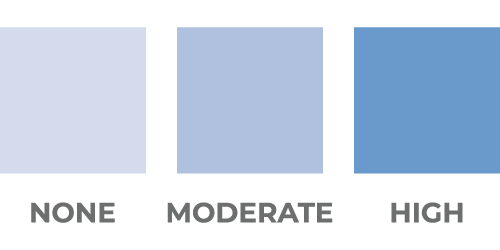

Excise taxes can greatly vary from state-to-state. To keep things simple, we have split states into three different tiers; no tax, moderate tax, and high tax. Hover over a state to see that state’s specific tax information as well as if non-nicotine e-liquid is taxed in that state.

For you convenience, the full tax guidance published by each state can also be found in the list below.

STATE | VAPE TAX & E-CIG TAX | IS NON-NICOTINE E-LIQUID TAXABLE? | ADDITIONAL INFORMATION |

|---|

| Alabama | no tax | No | |

| Alaska | no tax | No | |

| Arizona | no tax | No | |

| Arkansas | no tax | No | |

| California | California requires 63.49% tax on the wholesale price of both traditional tobacco-based nicotine vapor products and tobacco-free nicotine products. | No | Read More |

| Colorado | 30% manufacturer list price | No | |

| Connecticut | Connecticut requires 10% tax on the wholesale cost of all open systems and $0.40/ml tax on all closed systems. | Yes | Read More |

| Delaware | Delaware requires a tax of $0.05/ml on nicotine e-liquid. | No | Read More |

| District of Columbia | The District of Columbia (Washington, D.C.), requires an excise tax equal to 91% of wholesale cost on all devices, components, and nicotine e-liquids. “Accessories” such as chargers are excluded. | No | Read More |

| Florida | no tax | No | |

| Georgia | Georgia requires a tax of $0.05/ml on all consumable vapor products for use in a closed system. They also require a tax of 7% of the wholesale cost for consumable vapor products for use in an open system. Finally, Georgia requires a tax of 7% of the wholesale cost on disposable devices containing nicotine. | Yes | Read More |

| Hawaii | no tax | No | |

| Idaho | no tax | No | |

| Illinois | Illinois requires a tax of 15% of the wholesale price of all vapor products. Accessories such as chargers are not included. | Yes | Read More |

| Indiana | no tax | No | |

| Iowa | no tax | No | |

| Kansas | Kansas requires a tax of $0.05/ml on all e-liquids, including 0% nicotine e-liquids. | Yes | Read More |

| Kentucky | Kentucky requires a tax of 15% of the wholesale cost on all open system products and components including e-liquid and devices, and $1.50 per closed system including pods and cartridges. | Yes | Read More |

| Louisiana | Louisiana requires a tax of $0.05/ml of nicotine liquid. | No | Read More |

| Maine | Maine requires a tax rate of 43% of the wholesale price for all ENDS products. | Yes | Read More |

| Maryland | Maryland requires a tax of 12% of the retail price on: open-system devices, components, accessories, and nicotine liquids over 5ml. The tax on nicotine liquids sold in a container that contains 5ml or less of vaping liquid is 60% of the retail price. Batteries and battery chargers are excluded. | No | Read More |

| Massachusetts | Massachusetts requires a tax of 75% of the wholesale price on all e-liquids, devices, components and accessories. | Yes | Read More |

| Michigan | no tax | No | |

| Minnesota | Minnesota requires a tax of 95% of the wholesale cost on any component of electronic cigarettes or nicotine e-liquids. | No | Read More |

| Mississippi | no tax | No | |

| Missouri | no tax | No | |

| Montana | no tax | No | |

| Nebraska | no tax | No | |

| Nevada | Nevada requires a tax of 30% of the wholesale cost of all e-cigarette products. | Yes | Read More |

| New Hampshire | New Hampshire requires a tax rate for closed system e-cigarettes of $0.30/ml and a tax rate for open system e-cigarettes of 8% of the wholesale sales price of the container of liquid or other substance containing nicotine. | No | Read More |

| New Jersey | New Jersey requires a tax of 10% of the retail cost for all open systems and a tax of $0.10/ml for all closed systems, such as pods and disposables, with a proportionate tax rate for fractional parts of a fluid milliliter of volume of liquid nicotine. | No | Read More |

| New Mexico | New Mexico requires a tax of 12.5% of the wholesale cost on all open systems that contain more than 5ml and a tax of $0.50/cartridge for closed systems under 5ml. | Yes | Read More |

| New York | New York requires a tax of 20% of the retail cost of all finished goods ENDS products. | Yes | Read More |

| North Carolina | North Carolina requires a tax of $0.05/ml on all nicotine e-liquids. | No | Read More |

| North Dakota | no tax | No | |

| Ohio | Ohio has a tax of $0.01/0.1ml (the equivalent of $0.10 per milliliter) for cartridges, pods, nicotine e-liquids, kits, and devices that contain nicotine. | No | Read More |

| Oklahoma | no tax | No | |

| Oregon | Oregon requires a tax of 65% of the wholesale cost of devices, components, and e-liquids (this includes pods and disposables). | Yes | Read More |

| Pennsylvania | Pennsylvania requires a tax of 40% of the wholesale cost of all ENDS products. | Yes | Read More |

| Rhode Island | no tax | No | |

| South Carolina | no tax | No | |

| South Dakota | no tax | No | |

| Tennessee | no tax | No | |

| Texas | no tax | No | |

| Utah | Utah requires a tax of 56% of the wholesale cost on all ENDS products. | Yes | Read More |

| Vermont | Vermont requires a tax of 92% of the wholesale cost of all ENDS products. | Yes | Read More |

| Virginia | Virginia requires a tax of $0.066/ml of nicotine liquid in solution. | No | Read More |

| Washington | Washington requires bottles greater than 5ml be taxed at a rate of $0.09/ml. All other vapor products, including cartridges, pods, disposables, and kits containing liquid, must be taxed at a rate of $0.27/ml. | Yes | Read More |

| West Virginia | West Virginia requires a tax of$0.075/ml of e-liquid. | Yes | Read More |